Energised about Project EnergyConnect

Delivering 800MW of new transfer capacity into the National Electricity Market (NEM), enabling renewable generation to be shared across three states, is a step closer to the first commissioning phase. Extensive planning and development to bring Project EnergyConnect (PEC) online is well underway and consultation processes are near complete (market integration) or about to commence (draft inter-network testing program) and regular progress updates to industry are occurring. This article describes the tip of the iceberg and in no way does justice to the extensive power system planning, modelling, community and stakeholder engagement, engineering design and construction, commissioning and market integration activities of bringing a new interconnector into the NEM

Project EnergyConnect (PEC) – what’s happening

PEC -1 comprising the South Australian side of the project and section of line from the border to Buronga in NSW is getting ready for its first energisation and testing, while PEC- 2 is underway on the NSW side with a sizable job ahead to complete construction. Bringing PEC-1 into the NEM is getting close with the drafting of inter-network test plans, and market integration activities.

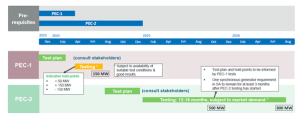

To bring PEC-1 online there is a need to define the limits and constraint equations that are loaded into the market dispatch engines, the inter-network test plan needs to be finalised and then after years of work a switch is flicked and PEC – 1 is live in the NEM. While it doesn’t go to full capacity on day 1, the transmission line gradually goes through hold points and builds up power transfer capability over time. The power system is monitored for any issues while in this testing phase. Testing is just that, a test on the live power system and it can all work perfectly or there could be impacts that occur that are not expected from the modelling undertaken. How quickly PEC -1 can progress through these hold points to a transfer capacity of 150MW will depend on any concerns reported regarding the stability or protection schemes during the test and on market conditions that facilitate the increased transfer capacity, see Fig 1.

Learnings from PEC – 1 will help inform the testing needed for PEC – 2. The limits and constraint equations for PEC – 2 are expected to be completed by end 2024 and inter-network testing undertaken in 2025. PEC-2 is planned to reach 500MW capacity by the end 2025 with increasing transfer capacity to 800MW by mid-2026, subject to market conditions. When PEC-2 is operational, the AEMO plans to operate the SA power system some time in the future without any synchronous generators, and South Australia would be relying on the synchronous condensers, renewables and batteries to maintain the power system under normal conditions and the interconnectors would help supply diversity and power system stability.

Fig 1 – PEC Capacity release dates[1]

Hooking new transmission into the NEM and testing

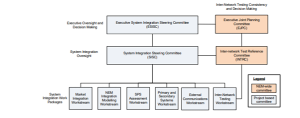

The dust has been removed from AEMO’s Inter-Network Test Guidelines[2] and they are now getting a good work out as minor interconnector upgrades (eg QNI minor) are brought on line and new greenfield projects like PEC are tested and integrated into the National Electricity Market. These Guidelines establish a rigorous governance framework to test new transmission infrastructure in accordance with the National Electricity Rules, 5.7.7, see Fig 2 and Fig 3.

Fig 2 – Inter-network testing governance, workstreams and reporting in relation to 5.7.7 obligations

Given PEC spans three states, the System Integration Steering Committee (SISC) is a collaboration of the TNSPs involved – ElectraNet, Transgrid and AEMO Vic planning/AusNet Services and the market operator, AEMO.

The SISC has responsibility for assessing the material inter-network impacts, the modelling and analysis and testing required and overseeing the work packages in the workstreams indicated above. The steps to meet the 5.7.7 requirements are indicated below, Fig 4. For PEC the draft testing program for Stage 1 will be published shortly for consultation following an overview provided to stakeholders on 23 November 2023.

Fig 3 – 5.7.7 process step diagram

To start testing, a green light is needed on the following:

- AEMO market systems need to be ready

- All network infrastructure is ‘AEMO asset ready’

- Relevant special protection schemes have been reviewed/commissioned; and

- Limits advice has been provided by TNSPs and developed into constraint equations by AEMO.

Integrating new transmission into the market

The second phase of consultation is on market integration and the treatment of settlement residues, on which comment is due to close this week.[3] The consultation covers the;

- Management of negative inter-regional settlement residues;

- Reallocation approach options for settlement residues;

- Payment options for negative inter-regional settlement residues; and

- Implementation considerations.

AEMO will assess responses received to this current round of consultation, publish recommendations and initiate the relevant rule change and AEMO Procedure changes needed.

Managing new connections

New greenfield transmission projects need to reach a certain stage before connection enquiries to the new infrastructure under construction can be formally lodged and progressed. This stage is called a considered project. To be classed as a considered project the following conditions need to be met:

- Necessary land and easements have to be acquired

- All necessary planning and development approvals have to be obtained

- The project has to have passed the regulatory investment test for transmission and

- Construction has to have commenced or a firm date is set to commence.

PEC reached this stage in March 2023, enabling renewables projects that have been champing at the bit for years to formally lodge and progress connection enquiries.

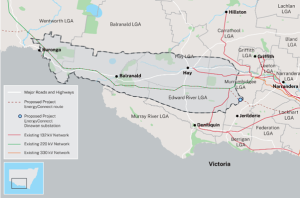

The South Australian side of PEC is operating under the National Electricity Rules and is subject to open access and Chapter 5A connection processes, similarly for some areas on the NSW side. Other areas on the NSW side are subject to the arrangements for the NSW South West Renewable Energy Zone (SW REZ), see Fig 4.

Energy Co (in NSW) has consulted on a staged approach for the access scheme for SW REZ and has yet to make a final decision. In the earlier consultation it was clear that some prime farming land would be considered off limits for new renewable generation connections, whilst other areas would be subject to the normal connection process with oversight (or right of veto) by Energy Co up to a certain capacity. The PEC website will be updated with a framework for connecting into PEC to outline the pre-requisites for connection enquiries and application processes.

Fig 4 – NSW South West Renewable Energy Zone

PEC has travelled a long road and has in many ways been a trailblazer all the while driving change to streamline the regulatory planning and approval processes. This has enabled more timely and efficient investment in other major transmission projects required to support the clean energy transition.

PEC -1 is nearing completion, and PEC- 2 has a bit further to go to reach the end point of 800MW of additional transfer capacity. It’s a landmark project, the first large interconnector in 15 years. It will benefit residential bills by enabling lower-priced renewables, increasing economic activity and improving energy security. ElectraNet is clearly energised about moving South Australia to lower-cost renewables, which already provide more than 71% of its annual electricity generation and are forecasted to reach 100% by 2026-27.

[1] Project EnergyConnect System Integration, Industry Update, 23 Nov 2023

[2] https://aemo.com.au/-/media/files/stakeholder_consultation/consultations/nem-consultations/2023/inter-network-test-guidelines/final-documents/inter-network-test-guidelines-v22-clean.pdf?la=en

[3] https://aemo.com.au/en/consultations/current-and-closed-consultations/project-energy-connect-market-integration-paper