Renewable gas: Policy options to support Australia’s decarbonisation journey

Renewable gas will be needed to decarbonise Australia’s economy, starting with the industrial sector. KPMG recently completed a report for Energy Networks Australia to outline a policy pathway for renewable gas. Based on our review of KPMG’s analysis, key recommendations for policymakers are:

- To set and promote a 2030 renewable gas target.

- To establish a national market-based renewable gas certificate scheme to commence in the late 2020s.

- Prior to that, supporting projects for price discovery of hydrogen and biomethane via direct government support.

- Develop a range of supporting policies to facilitate the renewable gas market.

We take a look at these key recommendations and how the energy sector can and should respond to the opportunities for renewable gas and its place in our energy mix.

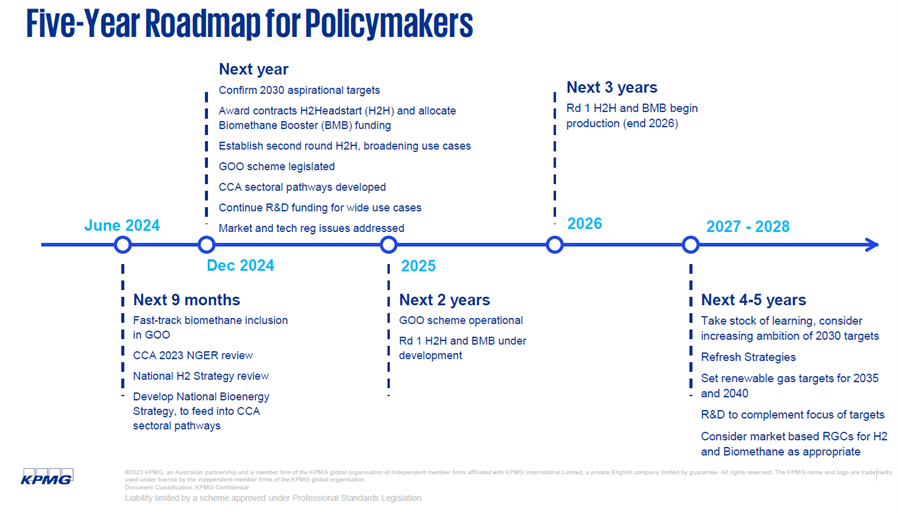

In addition, KPMG has plotted a five-year roadmap to assist governments, market bodies and networks in planning their progress until 2028.

Governments can set and promote renewable gas targets.

The role for renewable gas in Australia’s future energy mix is well founded. For example: Victoria’s gas substitution roadmap[1] recognises the role of renewable gas.

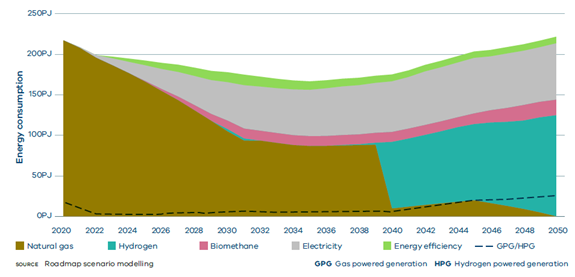

Figure 1: Victorian Energy consumption modelling – Zero carbon fuels future scenario (Source: VGSR modelling)

As shown in Figure 1, the large step change in hydrogen demand in 2040 and beyond reflects whole industries switching at the same time to comply with an emissions constraint. This is an artefact of a modelled ‘least cost’ development path and it would be virtually impossible to introduce over 80PJ of hydrogen in a single year. In practice, proactive policies are needed now to develop this market so that the capacity to meet demand for hydrogen will be there in the 2040s.

A 2030 target should be set by the end of 2024, and a 2035 target should be set in the late 2020s. This can allow for price discovery of renewable gases and introduce the learnings from early projects so that the market can efficiently transition to being driven by a renewable gas certificate scheme.

Separate hydrogen and biomethane targets can support industry development.

Hydrogen and biomethane are at very different levels of commercial maturity, and developing these industries may warrant separate targets. Without separate targets, it is likely biomethane will dominate the target as it has significant advantages[2] over hydrogen today. This may hinder the development of hydrogen, which will be needed in the late 2030s as shown above. Any policymakers considering the implementation of a renewable gas certificate scheme will need to carefully consider, at the time, the relative maturities of each fuel source and whether separate targets are warranted.

A national market-based mechanism using renewable gas certificates is the most economically efficient scheme to reach these targets in the medium term.

The objective of setting a renewable gas target should be clear. Common policy objectives include:

- Reducing emissions,

- Developing the renewable gas industry,

- Improving energy security and/or

- Building new demand-side industries.

The priority of the policy and the maturity of the market can affect the design of a target scheme.

If the sole objective is to reduce emissions at the lowest cost, then a national certificate-based scheme would be most efficient as it would allow the lowest-cost resources to be developed across the broadest geographical area. Within a certificate scheme, the beneficiary of the emission reductions associated with the certificate should pay.

This market-based approach is appropriate when there are fairly well-established technologies.

Price discovery and market sizing can be incentivised by direct government funding.

Developing the renewable gas industry should be done in parallel with the establishment of a certificate scheme, as this can take three to four years. The existing hydrogen blending projects, which have been supported by the government, are part of the pathway to developing the renewable gas industry. The largest project, AGIG’s Hydrogen Park Murray Valley[3], with a 10 MW electrolyser, reached the Final Investment Decision recently and is expected to be operational in 2025.

Additionally, the Commonwealth’s Hydrogen Headstart program aims to support up to 1 GW of electrolysers, focussing on two or three major projects. Given the limited information on the real cost of renewable gas projects at scale and the time delay to introduce legislation for a certificate based scheme, KPMG recommends that additional production projects and use cases for renewable gases are supported via government funding. This could complement the Hydrogen Headstart program but focus on other industry sectors or delivery infrastructure. A similar approach could also be introduced to progress biomethane projects using different feedstocks.

Supporting renewable gas policies should also be pursued.

As noted in Gas Vision 2050 – Delivering the pathway to net zero[4], there are cross cutting actions required to deploy the renewable gas market. Many of these actions are underway but more work is needed. In particular, the following supportive policies need to be progressed.

- Complete renewable gas certification schemes and accelerate the introduction of biomethane within those schemes.

- Ensure that the NGER review considers how renewable gases can be recognised as having net-zero emissions.

- Develop a high-level National Bioenergy Strategy to inform the development of sectoral decarbonisation pathways.

Policy refresh

Renewable gas will be needed to decarbonise Australia’s economy. A supportive policy environment can incentivise industry to introduce renewable gases by the 2030s to help meet national and state-based emission targets.

Further info

The KPMG report on Policy Options to Support Australia’s Decarbonisation Journey can be found at: https://www.energynetworks.com.au/projects/gas-vision-2050/.

[1] Victorian Government (2022), Gas Substitution Roadmap.

[2] The advantages includes that biomethane is a direct substitute for natural gas, that some biomethane resources can be developed at lower cost that hydrogen and that biomethane could relatively easily be developed from upgrading landfill gas.

[3] https://www.agig.com.au/hydrogen-park-murray-valley

[4] Gas Vision 2050 (2022), Delivering the pathway to net zero for Australia – 2022 outlook