System security services – the unsung hero of the transition

One of the quiet achievers of the transition to net zero is system security services. That is, the services other than energy that big mechanical spinning machines like coal and gas fired generation bring to the power system and that are falling away as they exit the system. How we get these services delivered to the system throughout the transition to net zero will be critical to achieving a lower costs transition for customers.

In recent years, the Australian Energy Market Commission (AEMC) has given transmission businesses (TNSPs) the role of procuring key system services in planning timeframes. These include system strength, which helps control voltage, and inertia, which helps control the frequency on the power system. Think of these as the blood pressure and heartbeat of the system.

The AEMC is currently considering a rule change on how we deliver system security services in operational timeframes. That is, how we schedule, dispatch and pay for these services in real time when they are needed.

The work is complex and difficult. These new services have unique characteristics and are difficult for engineers, let alone lawyers, to define. It is naturally taking some time to get it right. Critical to getting the right outcome for customers is to allocate roles and responsibilities appropriately, and consequently to allocate risks appropriately. A few factors are important to note here:

- Scheduling and dispatch of system services (lining them up and telling them to get going) are functions best handled by the market operator. AEMO is best placed to co-optimise the dispatch of system services in real time because this role is intimately linked with the outcomes of dispatching energy and frequency control services in real time. They are therefore best placed to understand the outcomes in existing markets in order to minimise the costs of any additional services needed to keep the system secure.

- Transmission businesses are not well placed to handle the financial settlement (handing over the cash) of the costs of real-time dispatch of system services. This is because the coal, gas and hydro generators called to provide system services will need to be compensated for the other costs they incur, such as the cost of negative wholesale energy market prices at the time they are called upon. These costs will likely be significant and highly variable, which creates risks that TNSPs are not well placed to face.

The first of these points is quite straight forward. It makes logical sense that the party with responsibility for efficiently dispatching coal, gas and hydro generators to provide energy in the wholesale market, would be best placed to also efficiently dispatch those same generators to provide other essential system services. If you separate these responsibilities the only logical result is a less efficient dispatch of services across the NEM, and higher costs for customers.

The second point, however, is less straight forward. It requires some mind-bending mental mathematics to quantify the costs and risks involved – so we asked some smart people to do this for us. Endgame Economics prepared a report to help us make the case to the AEMC and others that TNSPs are not well placed to face the cash flow risk that real-time settlement would entail. That is, the risk that TNSPs would be out of significantly out of pocket for periods of time until they can get cost recovery for the sums they have paid for the real-time enablement of system security services.

Endgame modelled the future payments that might be required to make generators whole (i.e. compensate them for losses in the wholesale market) if called upon to provide system strength services. The modelling was very conservative in its assumptions. It assumes that hydro will provide services for free, that all the providers of system strength will be physically available at all times and will enter contracts that ask for no more than short run marginal cost for enablement.

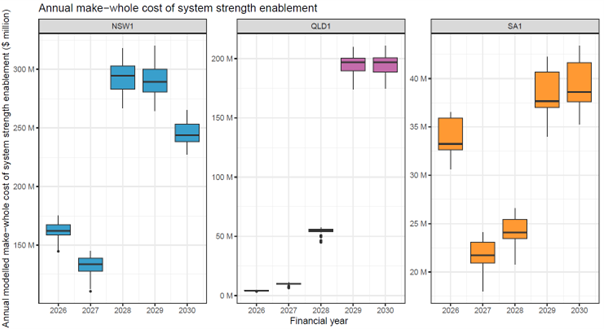

Figure 1: Modelled annual make-whole system strength costs for Queensland, New South Wales and South Australia, 2025/26 to 2029/30

The make whole payments are large and highly variable. There are two main drivers of this:

- The quantity of enablement is expected to be highly uncertain as it relates to uncertain outcomes in the wholesale energy market, and in addition could potentially be influenced by perverse incentives for synchronous generators to decommit from the energy market during periods of sustained, predictable periods of negative spot prices (e.g. during spring and autumn) to be called on for system security reasons.

- There is a potential for generators to seek wholesale spot price‑linked contracts given the expected higher frequency and increasing depth of negative price periods in the NEM over the five years to 2029/30.

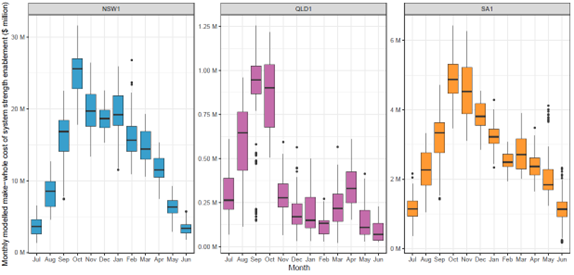

Also significant is the month-to-month uncertainty in system strength enablement payments. Figure 2 shows that the value of make whole payments varies significantly month to month throughout the year, and also has significant uncertainty within any given month.

Figure 2: Modelled monthly system strength make-whole enablement costs for Queensland, New South Wales and South Australia in 2025/26

This modelling helps to inform the best design for settlement of these services – the mechanism through which real-time enablement costs for system strength (and other) services are recovered. The most recent iteration of the AEMC’s design is that these costs would be recovered by TNSPs and there would be a true-up in time. As we can see from the above, this would expose TNSPs to cash-flow risks that are very significant. If you factor in that this modelling is incredibly conservative, it is conceivable that a TNSP’s forecast of system strength payments in any given year could leave them exposed to cash flow risk in the hundreds of millions of dollars. That is, cash requirements that are similar in magnitude to their entire operational expenditure budgets for the year.

This magnitude of cashflow risk is not appropriate for entities like TNSPs that are not well placed to manage these risks. Indeed, the options for TNSPs to manage these risks generally involve their contractual reallocation to parties that could manage the risk only by including a risk premium on the contract price. The Endgame modelling is perhaps also enlightening on the potential scale of any contractual risk premium, which tells us how much more customers could pay if this were to occur.

A preferred outcome would be for AEMO to settle the variable real time enablement payments for system security services within the weekly market settlement system. This would be an extension of AEMO’s existing settlement functions and would have the benefit of taking away the significant cash-flow risk that could be inappropriately allocated to TNSPs. There is minimal risk of perverse outcomes from this approach:

- It shouldn’t involve any over-recovery from TNSPs, who can adjust their revenues to take account of any payments they have already received from generators for providing system strength or other services.

- It shouldn’t adversely influence the TNSP’s role in efficient procurement of system services in planning timeframes. Indeed, TNSPs would still have the right incentives to manage system services contracts in a way that minimises costs to consumers, through the regulatory investment test process.

We look forward to working constructively with AEMO, the AEMC and any other interested parties, to ensure a system security framework that can facilitate the continued decarbonisation of the electricity system at least possible cost to consumers.