Rewiring the grid, moving to net zero – it is a big change

AEMO, the Australian Energy Market Operator, has released the 2024 Integrated System Plan (ISP), the second ISP under the rules framework which continues to highlight the need for new transmission to connect geographically-diverse renewables and enable electricity to be conveyed to load centres.

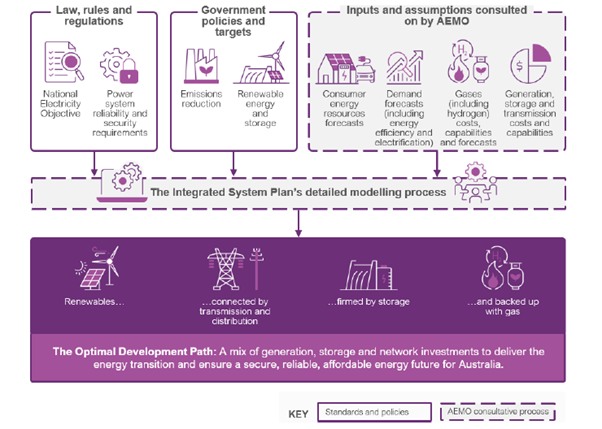

The ISP is a ‘least regrets’ development pathway, modelled to meet the stated emissions targets, and it assumes that other government policies are delivered on time and in full. Uptake of Consumer Energy Resources (CER) (passive and orchestrated) are inputs and assumed to be delivered. The model solves for the needed grid-scale generation, storage and new transmission as indicated below in Fig 1.

Fig 1 High level inputs and outputs of the ISP methodology[1]

New generation, transmission and storage are massive multi-year projects and need to consider options, and be subject to rigorous approvals. These projects take time regardless of which rules framework they are delivered under. The ISP notes that transmission projects are underway for 5,000 km of the 10,000 km needed by 2050. The ISP is updated every two years and is able to take account of changes in inputs and government policies, including changes in technology and costs.

Network projects on the Optimal development path

Around 90% of the coal fleet in the NEM is expected to retire by 2035. The ISP provides a least regrets optimal development path to replace these assets and meet government policies. However, timeframes to deliver the committed and actionable ISP projects are narrowing given the imminent emissions targets set.

In the committed and anticipated category, the following projects are well underway and are expected to be in service now or within the next 5 years:

- Far North Queensland REZ

- Project Energy Connect, of which the South Australian side is already energised

- An uprated Western renewables Link

- Central West Orana REZ

- CopperString 2032.

Similarly from mid-2026 over the following seven years, the ISP has reconfirmed the following actionable projects which will be developed under the ISP/NER framework or under the NSW Roadmap framework and should be delivered urgently:

- HumeLink

- Sydney Ring North (Hunter project)

- New England REZ infrastructure

- Victoria to New South Wales Interconnector (VNI West)

- Project Marinus.

The newly actionable projects, with a similar urgency to the projects above, will be progressed under the Queensland or NSW state frameworks or under the ISP /NER framework. They include:

- Hunter Central Coast REZ

- Sydney Ring South

- Gladstone Grid Reinforcement

- Mid North SA REZ

- Waddamana to Palmerston transfer capacity upgrade

- Queensland SuperGrid South

- Queensland to NSW Interconnector (QNI Connect).

The ISP also highlights a further twelve future actionable projects where TNSPs will need to undertake preparatory activities. These broadly cover REZ expansions, connecting offshore wind and reinforcing existing grid.

The transmission costs are $16b of the $122b in capital investment needed out to 2050 across transmission, generation and storage. These transmission costs pay for themselves and save consumers a further $18.5b in avoided costs and deliver emissions reductions valued at $3.3b. Without these transmission projects consumers will pay more.

Delay to these projects can result in additional costs, like the Eraring deal where the generator is funded for 80% of its losses up to a cap of $225mpa for each opt in year and where there is a profit for an opt in year a 20% share up to $40mpa will be paid to NSW[3]. This enables Eraring to continue to supply in NSW, subject to no major equipment failures and subject to them continuing to opt in each year. These costs would be spread across around 3.5m electricity accounts in NSW to maintain reliable supply and keep the power system secure. Actively seeking to maintain electricity supply should not be left to chance.

Delivery risks of the transition

AEMO consider there are four areas for market and policy settings to keep the transition on track:

Risk of insufficient infrastructure investment – timely investment decisions are required. Delays and uncertainties in regulation, planning and environmental approvals add to the risk of project delays. The ISP continues to show the importance of gas for firming and the need for gas capacity in the development path.

Risk of early coal retirements – AEMO rightly notes that coal retirements are being bought forward and that aged coal generators are being more unreliable. NSW has made a deal to extend Eraring coal generation until August 2027 which will come at a cost to electricity consumers. Coal generators need to provide three and half years notice of closure, in the current climate new investment may take longer to deliver, leaving the reliability gap and the potential for more coal generation extension deals.

Risks that the market and power systems are not ready for 100% renewables – The ISP notes that on average renewables accounted for 40% of the generation mix in the NEM in 2023 and was as high as 72% momentarily on 24 Oct 2023. There needs to be an uplift in system services and operational capability to ensure a stable, reliable grid. We must collectively consider how how to deal with peak demand (with high renewables and with lengthy renewable droughts) and new lows of minimum operational demand through all the events that are thrown at the grid. System strength arrangements are moving forward but are not without their challenges.

Risk that consumer energy resources are not adequately integrated into the grid – In this ISP AEMO has undertaken a sensitivity of what happens if consumer energy resources are not orchestrated. If the small increment of consumers energy resources are not orchestrated consistent with the ISP inputs then this would cost consumers an extra $4.1b in additional grid scale investment.

Risks that social licence and supply chains are not secure for project delivery – there is a continued need to improve the social licence within communities, get into the global markets to secure supply early and to secure the workforce needed.

ENA notes that the federal Nationally Significant Transmission Project framework is working on some of these risks and may have the potential to streamline some aspects. No doubt more will be revealed after the July 2024 ECMC meeting. NSW has also just announced a critical state significant infrastructure framework for 6 projects to help maintain energy supply and system security and streamline consent.[4]

[1] AEMO 2024 ISP for the NEM, p41

[2] AEMO 2024 ISP for the NEM, p15

[3] https://www.energy.nsw.gov.au/sites/default/files/2024-05/NSW-202405-Public-summary-of-Generator-Engagement-Project-Agreement.pdf

[4] Minister for Planning and Public Spaces, Paul Scully, NSW Government, Media Release – Six projects declared critical to NSWs clean energy future

[5] https://www.linkedin.com/pulse/does-gencost-treat-nuclear-unfairly-tennant-reed-en9wc/?trackingId=DbscVt%2F6RBSKSYGgitOJQg%3D%3D

[6] https://www.abc.net.au/news/2024-03-16/nuclear-power-in-australia-silver-bullet-white-elephant/103571824

[7] https://www.csiro.au/en/research/technology-space/energy/GenCost

[8] CSIRO report p72-75