Research enabling deployment: highlights from the Australian Hydrogen Research Conference

Hydrogen continues to be called out as a solution to decarbonise many sectors of the economy. While hydrogen is already used in some commercial sectors, such as ammonia production, its broader application will require further research, development and market creation.

The Australian Hydrogen Research Network recently held its second conference in Perth and we provide some of the key insights.

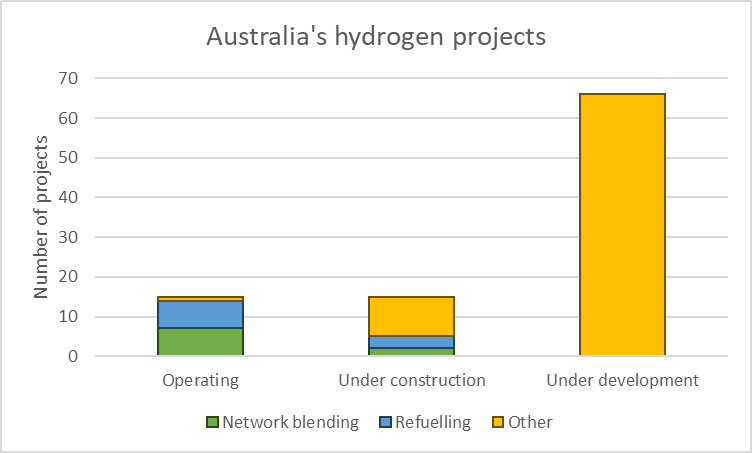

Australia hydrogen projects

Australia has an abundance of hydrogen projects. HyResource reports that there are around 100 active industry projects at different states of development and 410 research projects around the country.

The majority of projects are in their early stage and under development. The operational projects comprise mainly of hydrogen blending in gas networks or hydrogen refuellers to support mobility. Blending hydrogen in gas networks creates an opportunity to build hydrogen production capacity.

Figure 1: Active hydrogen projects in Australia (Source: HyResource; ENA analysis)

The last few weeks have seen some major players in the green hydrogen space take a step back to re-evaluate their plan. It is not just Fortescue that has been front and centre for delayed hydrogen projects – Woodside and Origin are among the larger companies who have recently shelved previously announced projects. This is happening globally with the roll-out of hydrogen falling behind what were always very ambitious numbers. Nevertheless, there are positive developments with six major projects[1] reaching Final Investment Decision in Europe in the last few months. This collectively represent nearly 1 GW of electrolyser capacity, set to be built by 2030.

Factors delaying deployment

While project delays and terminations may be seen as a concern, it is not unusual to see highly-ambitious targets for new technologies which then correct as the market matures. There are some common issues that need to be explored:

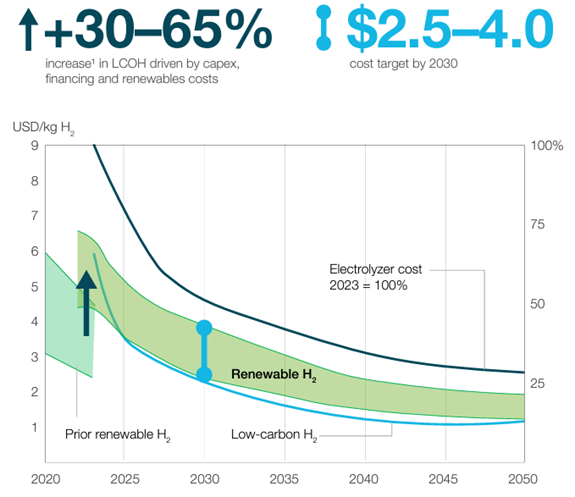

- Production costs for green hydrogen (made from splitting water using renewable electricity) were projected to decline. Unfortunately, increases in the costs of materials and energy, and increases in financing have driven up the cost of electrolysers[2] and the near-term cost of hydrogen between 30 and 65 per cent. This essentially means that the technology is not being pushed down the cost curve as much as was previously anticipated. The higher costs slows the deployment, while also slowingthe rate of potential cost reductions.

Figure 2: Renewable hydrogen production costs (Source: Hydrogen Council, 2023)

- Lack of demand, which is also relates to cost. There are many applications where hydrogen can be used but currently no major incentives for major users to switch to a more costly alternative fuel. Existing users of hydrogen can continue to operate with hydrogen produced from natural gas and new users of hydrogen may need to invest heavily into their factories to be able to use hydrogen.

- Infrastructure is also needed to balance between supply and demand for hydrogen.

- Financing is a challenge as institutional investors do not like to invest in new products at scale. This creates a gap between where government is supporting a technology (for example, via ARENA funding) and where commercial interests take over.

The role of research

There are several areas where applied research can support the deployment of hydrogen, and these are also applicable to other new energy technologies.

- Economic impact studies can provide better cost-benefit analysis and demonstrate how hydrogen can contribute to economic growth and job creation.

- Learning from others via case studies and benchmarking. A particular type of case studies is risk management to both identify risks with a new technology but also develop mitigation strategies.

- Improving social acceptance via social and environmental impact assessments. This could also extend to stakeholder engagement.

- Understanding demand across industries and competitive analysis between sectors via market analysis studies.

- Fundamental and applied research on technological advancements starting with proof of concepts and moving through towards pilot scale and large-scale demonstrations.

Is it a race?

Some hydrogen proponents indicate that there is a race to develop hydrogen. This seems to be based on the understanding that a business that is the market leader will be able to capture most of that market. It is likely that new opportunities will arise as the technology matures and the market develops.

Hydrogen is a long-term option to replace natural gas as a means to meet global emission reduction targets. Developing this option will continue to need industry led research and development as well as supportive policies to develop a market.

[1] https://www.linkedin.com/posts/hydrogencouncil_hydrogen-fid-electrolyser-activity-7227669746614177792-ws8b?utm_source=share&utm_medium=member_desktop

[2] Hydorgen Council (2023), Hydrogen Insights – Dec 2023