Affordability, decarbonisation and network resilience: how 2025-2030 initial regulatory proposals are shaping up

Last month, SA Power Networks, Energex and Ergon Energy (Energy Queensland) submitted their respective initial regulatory proposals for the 2025-30 period. These networks collectively distribute approximately 46,500GWh of electricity to almost 4 million homes and businesses through 300,000km of overhead and underground powerlines. There are several key overlapping themes in these proposals including affordability, decarbonising the network, maintaining reliable service, and network resilience.

These themes reflect broader trends in increasing electricity demand, cost of living and greater consumer participation. All proposals reflected the strong consumer engagement undertaken by SA Power Networks and Energy Queensland.

Efficient, Affordable and Equitable

SA Power Networks and Energy Queensland’s initial proposals feature strong consumer engagement feedback on the importance of keeping prices low. While there is strong consumer support and network recognition of the need to invest to incorporate new technologies and prepare for future demand, the networks committed to keeping prices as low as possible.

Consumer engagement has supported networks’ proposal to expand disadvantage and hardship programs. SA Power Networks plans to expand the ‘Knock Before You Disconnect’ program where a field crew deliver letters to customers who have unpaid bills to contact retailers for options prior to disconnection. In a trial run by Energy Charter signatories, providing customers with additional support has resulted in 80% of disconnections being cancelled by the retailer.

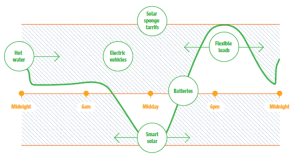

Equity was a key theme across the initial regulatory proposals. There was strong consumer feedback to see the benefits of Consumer Energy Resources (CER) technologies accessible to beyond only those who can afford the investment. To broaden the benefits of CER to all, SA Power Networks and Energy Queensland proposed updates to time of use tariffs as it is one way to encourage increased demand during the day when solar production is highest.

Figure 1: SAPN Potential load shifting options

(Source: SA Power Networks Draft Regulatory Proposal 2025-30, Page 54)

Decarbonising the network

For SA Power Networks and Energy Queensland, this regulatory reset period is pivotal in achieving net zero by 2050. Customers are increasingly taking an interest in CER, electric vehicles (EVs) and batteries, and networks are a key enabler to facilitate customer energy opportunities. Rooftop solar uptake presents a major opportunity for decarbonising the energy sector. In 2022, wind and solar made up 68% of electricity demand, expected to grow to 100% by 2028. However, larger quantities of solar PV also present challenges in demand management.

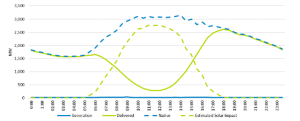

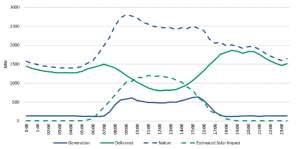

Energex and Ergon Energy’s proposals outline the opportunities and challenges of solar PV. Figures 2 and 3 show the impact of solar PV on daily load profiles and the differences between the two networks. As solar PV rates continue to grow, minimum demand is expected to fall, presenting challenges in managing reverse flows and associated power quality and stability issues. One of the driving factors of Energex’s capex forecasts is the proposed battery energy storage systems helping to balance supply and demand through load shifting.

Figure 2: Energex impact of solar PV on the daily load profile

(Source: Energex Regulatory Proposal 2025-30, page 70)

Figure 3: Ergon Energy impact of solar PV on the daily load profile

(Source: Ergon Energy Regulatory Proposal 2025-30, page 69)

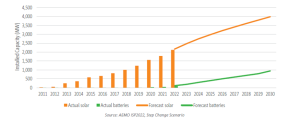

Similarly, the main component of SA Power Network’s proposed investments related to CER are targeted towards expanding capacity of network infrastructure in congested areas, as rooftop solar units and batteries continue to grow (Figure 4).

More than one-third of the 40,000 small-scale batteries in South Australia are enrolled in the Virtual Power Plant (VPP) scheme where the Australian Energy Market Operator (AEMO) centrally controls and operates batteries to balance daily loads. The central operation allows consumers to earn money using their batteries to trade in the wholesale energy market. SA Power Networks sets the guidelines for VPPs and proposes investment to further develop and scale up capabilities to enable higher volumes of batteries and VPPs, while also minimising the impacts on the network at least cost.

Figure 4: South Australian customer energy resources forecast

(Source: SA Power Networks Draft Regulatory Proposal 2025-30, page 51)

Maintaining reliable service

Electricity as a reliable service is a key theme across all proposals. SA Power Networks and Energy Queensland have recognised their respective aging networks and the investment required to update them to maintain reliability, especially in the face of increasing demand. EV uptake will make households more reliable on electricity supply, stressing the importance of a constant service. Forecast population growth and solar growth will also add to the reliability challenge.

SA Power Networks views an increase in replacement rates as necessary for the network to remain efficient, reliable, and safe over the long-term. Without sufficient investment in this area, gradual deterioration of service levels and safety risks can emerge. Ergon Energy is also committed to refurbishment and replacement works to upgrade its ageing network to meet community safety and reliability expectations.

Investing in a safe and resilient network

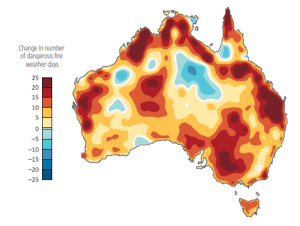

Similar to the NSW, ACT and TAS 2024-29 regulatory resets, resilience against weather-related events is a key investment focus for SA Power Networks and Energy Queensland. Climate change is forecast to increase the frequency and intensity of weather-related events such as bushfires, storms, floods, and cyclones.

Figure 5: Projected annual increase in risk of bushfire incidents 2021-22

(Source: SA Power Networks Draft Regulatory Proposal 2025-30, Page 36)

SA Power Networks has proposed targeted programs, such as safety augmentation and undergrounding, to reduce the risk of bushfires and reduce the impact of emergency power shutoffs. These programs are in addition to mitigation activities already undertaken.

Energex and Ergon Energy propose to reduce bushfire risk by installing covered conductor, sparkless fuses and pole wraps in bushfire prone zones and reduce flood risk through raising assets.

CER technologies present new opportunities and challenges for networks, including maintaining reliability standards. Climate change also presents new challenges and stresses the importance of network resilience. Affordability and the need for efficient investments were key themes from consumer engagement processes and highlights broader trends in cost-of-living pressures. These initial regulatory proposals showcase the increasing involvement of consumers and the importance and benefit in consumer engagement processes.

The AER is expected to publish its Issue Papers on these initial regulatory proposals in March 2024, allowing stakeholders to provide feedback on what has been proposed, with the AER’s Draft Decision published in September 2024.